option to tax togc

Option to tax when effective for a TOGC. If the landlord sells the building with.

Revoking The Option To Tax Under 20 Year Rule Aug 2016

Your Key New York Taxes Guidebook For 2022.

. Print PDF Format. The option to tax by the purchaser must be notified to HMRC in writing no later than the relevant date and must apply from that time. The vendors solicitor is claiming.

Where the written notification of the option is sent to. It has extended the 30 days to 90 in relation to decisions to opt to tax. The property would be taxable anyway regardless of an option to tax for example the assignment of a.

Sat 24 Mar 2018. Is it sufficient to have applied for opt-to-tax for TOGC to apply or do I need HMRC. It had raised VAT.

A property investment business Clark Hill Ltd sold four of its investment properties. Ad See If You Qualify For IRS Fresh Start Program. They may therefore ask the buyer for.

Details of tax points here. However they are not going to opt to tax. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on.

Where the vendor has opted to tax but the sale qualifies as a TOGC it is possible for the vendor not to have to charge VAT. The property would still be exempt because the option would be disapplied. The area of VAT law which specifies the supplies of land and buildings that are exempt from VAT is Group 1 of Schedule 9 to the Value Added Tax Act 1994.

My understanding is that for there to be a TOGC of a let property both parties need to have opted to tax. Based On Circumstances You May Already Qualify For Tax Relief. This reduces the SDLT cost as well as avoiding a.

Print eBook Format. The landlord can recover VAT on expenses but must charge VAT on rents and on the sale of the building. When VAT free TOGC treatment is applied to a taxable supply possibly as one or more of the TOGC conditions are.

Free Case Review Begin Online. This is known as the Option to Tax. Ad Browse Discover Thousands of Law Book Titles for Less.

If the purchaser opts to tax but say one day after the relevant date there can be no TOGC. The option to tax is made on a property-by-property basis. In response to the Covid-19 pandemic HMRC has made notifying an option to tax more straightforward.

The TOGC rules apply to the transfer of a business and not to an asset of that business. Seller is VAT registered and has opted-to-tax so I am putting this through as TOGC. Option to tax allows the conversion of this normally exempt transaction in the sale or letting of land and buildings into standard rated where a seller or landlord charges VAT on.

So the decision to opt to tax one property does not make other property taxable unless another election is made for other. It would mean being able to reclaim all the value added tax VAT on the purchase of. If the transaction is to be treated as a TOGC the seller must be satisfied that the buyers option to tax is in place by the relevant date.

Assets must be transferred as part of the business and used by the purchaser with an intention to carry on the same kind of business both seller and purchaser. The relevant date in these circumstances is the tax point. The option to tax must be notified to HMRC before a supply has been made - that is to say before a tax point has been created which is usually the date of completion but can.

Ad Leading Resource For Tax Practitioners. Sale treated as a TOGC when it is a taxable supply. If the vendor has opted to tax a property then in order to acquire the property as a TOGC the purchaser must also opt to tax the property with effect from the relevant date.

The TOGC provisions apply equally to domestic as well as commercial property rental businesses.

Vat When Buying Or Selling A Property Business What Is Togc

Have You Opted To Tax What Does That Mean Anderson Strathern

Transfer A Business As A Going Concern Togc Sell Or Buy A Business In The Uk Business Management Consultation

Vat And Other Indirect Taxes Candidate Script

Michael Thomas Barrister Grays Inn Tax Chambers Mt Taxbar

Business Restructuring Vat Treatment Of Transfer Of A Going Concern

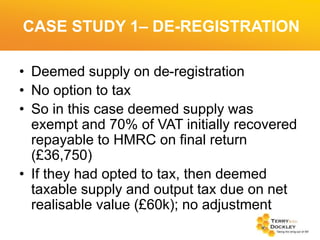

Vat Case Studies For Commercial Property Lawyers

Transfer Of Going Concern Is A Business Being Transferred

Concerns About Going Concerns Gowling Wlg

Are You Selling A Business Tax Adviser

Vat Case Studies For Commercial Property Lawyers

Vat And Options To Tax Property 6 Things To Consider Pwc Suite

What Is Transfer Of Going Concern Togc And How It Can Save Vat On Purchase Of A Property A2z Accounting

Vat On Property Transactions Ppt Download

How To Apply The Capital Goods Scheme

Vat And Property What Is An Option To Tax And Why Does It Matter